At a recent Odoo related conference it was announced that Odoo will soon be adding a new feature to their software platform that struck a familiar chord with us... because we already added it!

In 2023 we started working with a new client, operating within the construction industry in the UK. In the UK, there are special tax laws for the construction industry known as the Construction Industry Scheme (CIS), and tax returns have to be filed monthly via the HMRC "Making Tax Digital" (MTD) online system. At the time, out of the box, although Odoo did allow submission of VAT returns via MTD, it had no native support for the CIS Tax deductions or the related returns (a CIS300 return), and certainly didn't support the MTD submission... so we got to researching it and created a custom module for our customer.

What is Odoo CIS Tax?

Technical bit for those interested... we won't be offended if you skip this paragraph.

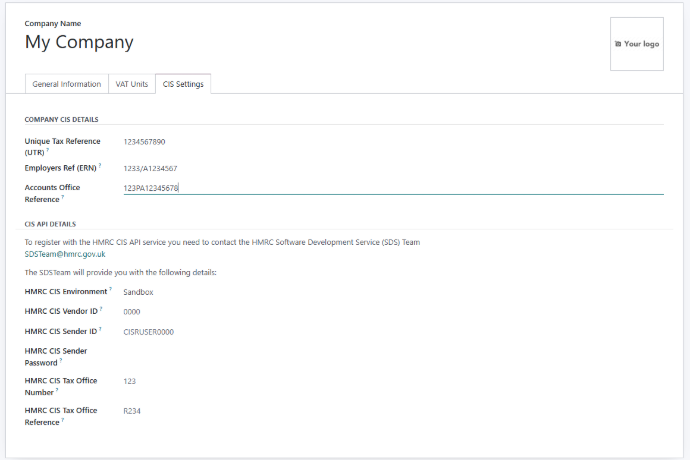

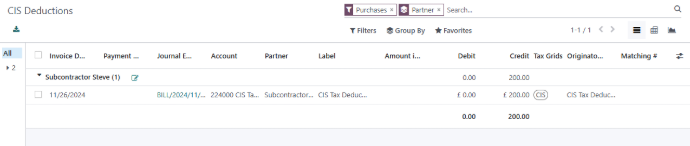

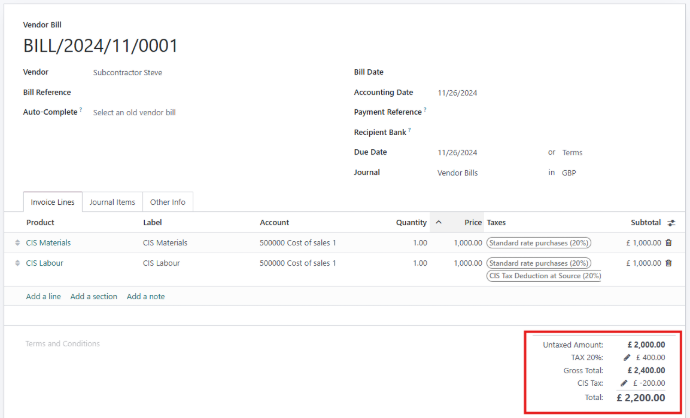

Our CIS module expands upon the native VAT filing system built into Odoo, and allows for a new CIS Tax Group that keeps a track of what tax is deducted, and adds a few new tax codes to allow for different rates to be deducted depending on the contractors "verification" status. The tax codes can be added to the contractors invoice and the system will calculate the correct deduction for you. We of course also had to add the ability to include the subcontractors NI number and UTR, which are required on the submission. Then, using a modified version of the existing Tax Report (the one used for UK VAT Returns) we provided a CIS summary report and a button to submit the return via the MTD system. Oh and it produces your CIS statements to send out to your subcontractors at the end of the month too.

We refrained from posting this module on the Odoo App Store for others to download and use because, among other reasons, we felt it needed more polish and some additional testing in other environments before we made it publicly available, after all we had only given it to one company with one set of specific needs, and they had only used it for a handful of months. As an Odoo partner, we caught up with the product owner of the Odoo Accounting module ato discuss what the CIS tax system is, how it works, and how we got Odoo to file the returns etc. We understand Odoo SA to be making this available in 18.0 very very soon, which is fantastic, but it got us thinking....what else do we have in our back catalogue that we should be sharing.....the answer is....lots!

CIS Tax in Odoo 18

Whether this Odoo CIS Tax feature will be made available for earlier versions of Odoo is yet to be seen, and it's quite possible it won't be, but we still have our version, and we could very easily adapt it to other versions of Odoo if anyone was interested.

If you are interested in Odoo, or are currently using Odoo, and you spot a feature you think is missing that would make your life easier, don't fret! Glo have a team of experienced and Odoo certified expert developers that thrive on finding ways to plug these kinds of gaps.

Get in touch and let us WOW you.